Legal

Top 100 UK Insurers 2024: Business lines

A ranking of the top 100 UK Insurers for different general insurance business lines, based on data from AM Best’s Financial Suite.

Big Interview: Jo Taylor, Endsleigh

Jo Taylor, executive director of Endsleigh, shares plans to consign the student specialist brand to the past, ways to attract fresh meat to the insurance market, plus how the broker is supporting schools and universities facing financial challenges in…

Sexual harassment in the workplace - A time for change

Changes around sexual harassment at work become law on 26 October 2024. This article explores the implications for employers in respect of their duties regarding the prevention of sexual harassment in the workplace.

RTA claim lands lying litigator in legal limbo

A paralegal who was found to have lied during their road traffic accident claim has been sentenced to one year in prison, suspended for two years.

Diminishing justice

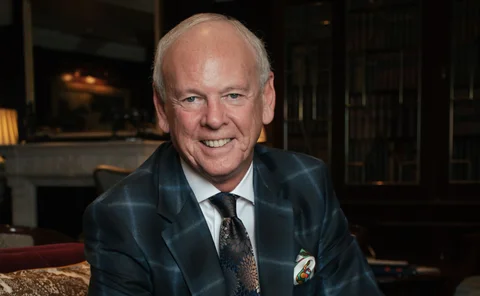

Tony Buss, CEO of ARAG, the UK’s leading insurer of legal costs has been a key figure in the fight for access to justice for nearly 40 years.

Kingfisher’s commercial acquisition; RSA’s D&O product; Zurich’s head of SME

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Insurance Post Claims and Fraud Award winners revealed

Allianz (including LV), Aviva, DWF and Sedgwick were all multiple winners at the Insurance Post Claims and Fraud Awards last night (3 October).

Problem tenants

Landlords following the news, who are worrying about problem tenants, will have seen that the government has launched a special fast track for repossession cases featuring antisocial behaviour cases.

Four ways to limit disrepair claims from your tenants

Allegations of disrepair can have an adverse effect on a rent protection claim if appropriate action hasn’t been taken to resolve any problems that are the responsibility of the landlord.

Brace yourself: Dental injury claims quadruple

Insurers have seen a marked uptick in claims involving dental injuries in the last three years, according to law firm HF.

60 Seconds With... HF’s Imogen Mitchell-Webb

Imogen Mitchell-Webb, head of sports at HF, on helping sports people return to competing, hating hoovering and spending her first wage packet in the village pub she worked in.

Fixed recoverable costs in low value clinical negligence claims

Pursuant to Sir Rupert Jackson’s proposals from 2017, the civil litigation landscape has recently faced imminent change vis-à-vis fixed recoverable costs, namely, the amount of legal costs that a winning party can recover from a losing party.

Q&A: Kim Harrison, Apil

Kim Harrison, president of the Association of Personal Injury Lawyers, discusses her ambitions for her presidency, diversity in the industry and the justice gap in injury claims.

Are insurers racing to be online-only excluding disabled customers?

As the insurance sector increasingly digitises, Damisola Sulaiman examines the barriers disabled customers face in accessing online insurance services, as well as the measures that have been implemented by insurers to address these issues.

The case for alternative dispute resolution

Adam Thorpe, associate director and head of litigation at Winn Group, examines how alternative dispute resolution could reduce lengthy court waiting times as well as getting compensation to claimants faster.

Clinical negligence fixed costs & disbursements

How and when will the regime for fixed costs in clinical negligence claims with a settlement value of less than £25,000 be implemented?

Ardonagh buys broker; Compass offers beach hut cover; Minster Law’s hire

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

RSA’s cloud solution; Allianz’s new stadium; Gallagher’s managing director

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

What Labour’s victory means for litigation funding in insurance

With a new Labour government in power, Glenn Newberry, head of litigation funding and costs at Eversheds Sutherland, reflects on what this could mean for litigation funding in the insurance industry.

Post-termination restrictions for partners and senior team members

If an employee or partner has knowledge of your clients and techniques, your strategic plans and staff data could be attractive to competitors.

Navigating data breach compensation claims

The extent to which damages can be claimed in the event of a data breach has been a hot topic over the last few years.

Longworth’s AI Code of Conduct has a ‘shelf life’

Eddie Longworth’s voluntary artificial intelligence (AI) code of conduct for the claims industry has a “shelf life”.

Terror charges for rioters could put insurance claims in doubt

Businesses reeling from damage caused by far-right riots across the UK in recent weeks may have their claims complicated if the perpetrators are charged with terrorism offences.

AI adoption is ‘running before walking’ for Charles Taylor InsurTech clients

Charles Taylor InsurTech’s mature clients are not ready to embrace artificial intelligence (AI), according to CEO Arjun Ramdas.