Insurtech

Webinar: Is it time the ABI GTA had specific rates for electric vehicles to change insurers' attitudes?

With over a million electric vehicles on UK roads, they are becoming increasingly important for motor insurers in managing portfolio growth and claims costs.

Verisk London 2024: Key takeaways

In the fourth and final video recorded at the Verisk Insurance Conference in London, Insurance Post content director Jonathan Swift spoke to delegates and speakers about the lessons they learned at this year’s event.

Spotlight: Why insurance can't afford to ignore RegTech

Within the insurance industry, regulatory pressures are intensifying, operational costs are soaring, and the ever-present threat of compliance violations could destabilise entire businesses.

Personalise insurance or fall foul of disruptors

The potential of personalisation and embedded insurance continue to excite the insurance market. David Worsfold explores what progress is being made and whether the innovation is being driven by mainstream players, disruptors or a combination of the two.

Spotlight: Tackling insurance's regulatory tsunami

Waves of regulatory initiatives are driving up costs, reducing profitability and slowing down business for insurance firms. This spotlight focuses on how insurance firms can respond to these challenges and address the regulatory tsunami.

Seven ways to modernise the claims experience - using what you already have

Filing a claim is a policyholder’s greatest moment of vulnerability and truth. How connected and competitive is your claims experience?

Sprout AI targeting one billion customers by 2030

Roi Amir, CEO of Sprout AI, said the firm is looking to reach one billion customers within five to seven years, and confirmed when the company will expand into pet and travel.

Pen’s cyber revamp; Chubb’s construction practice; Unum CEO joins ABI board

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Spotlight: Insurance's regulatory burden - are we to blame?

Seemingly relentless waves of regulatory change are battering the insurance sector.

2024 AI handbook for insurance leaders

AI will touch nearly every aspect of insurance - from broker operations to underwriting to risk management to claims processing and beyond. Insurers that adopt AI effectively will have an insurmountable advantage.

Guest podcast: How AI transforms automation and workflows

The AI era is still young, but early adopters are already seeing the benefits. If you want to stay ahead of the game, it’s critical to understand AI’s trajectory.

Ageas confirms exclusive talks over Saga ‘partnership’

Ageas has confirmed it has entered into negotiations with Saga for the distribution of motor and home insurance products to Saga's customers.

Automated claims management: Three pillars of success

In contrast to traditional approaches, automated claims management systems optimise underwriting efficiency with advanced algorithms and machine learning.

Treloar returns to insurance on Zego’s board

Steve Treloar is returning to insurance after more than a year out of the industry, as he is appointed to Zego’s board, Insurance Post can reveal.

The genie in the bottle: improving outcomes in income protection claims

At a recent Insurance Post roundtable in association with EvolutionIQ, specialists explored the challenges and opportunities for income protection insurers in supporting the ‘back to work’ mission.

Transforming the insurance industry with process intelligence

To truly become data-driven, insurers need solutions that make it easy to transform raw information into insights that lead to action.

Video Q&A: Access PaySuite’s Luke Gall

In the latest Insurance Post video, Access PaySuite product and engineering director, Luke Gall discusses the pain points he sees in the insurance sector and how his employer can help address them.

Earnix ‘not in the same boat’ as other insurtechs

Earnix is “not in the same boat” as other insurtechs as it looks to continue its growth plans, its CEO Robin Gilthorpe has told Insurance Post.

Kingfisher’s commercial acquisition; RSA’s D&O product; Zurich’s head of SME

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Lloyd’s Lab sets up insurtech investor panel

Lloyd’s Lab has set up an investor panel aimed at offering expertise and advice on the financial landscape and fundraising initiatives for insurtechs on its accelerator programme.

Q&A: John Dunn, Brokerbility

After more than 18 months into his role as MD of Brokerbility, John Dunn catches up with Insurance Post to discuss bring clarity to the networks, refreshing tired shcemes, and how he hopes to help partners and members "outperform the market"

Big Interview: Sten Saar, Zego

Sten Saar, co-founder and CEO of Zego, speaks to Damisola Sulaiman about the challenges of building an insurtech in an evolving landscape, the lessons he learned entering the complex world of insurance as an outsider, plus his plans for growing the…

Zego CEO outlines plan to become household name in motor

Zego CEO Sten Saar plans to focus on UK consumer and telematics for the next phase of the insurtech’s growth.

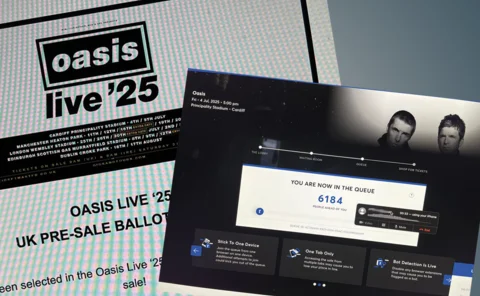

Lessons insurers should learn from Ticketmaster’s dynamic pricing

Editor’s View: Emma Ann Hughes questions whether the fallout from Ticketmaster’s dynamic pricing approach to selling Oasis tickets could have an impact on insurance premiums.