Harry Curtis

Chief Reporter, Post

Harry is chief reporter for Insurance Post covering commercial lines and the London market.

He joined Insurance Post in 2018 and won the British Insurance Brokers’ Association Most Promising Newcomer award in 2019. In 2022, he was highly commended in the Headlinemoney Awards General Insurance B2B Journalist of the Year category.

Follow Harry

Articles by Harry Curtis

Aon’s head of captives reveals checklist for UK regs

Following Aon’s announcement last week that it is setting up a UK captives management company, global head of captives Ciáran Healy has outlined the broker’s plans and what it wants to see from the prospective regime.

Raw materials price insurer seeks FCA authorisation

ChAI, a UK startup that allows businesses to manage supply chain risk by insuring against fluctuations in the price of materials, is seeking authorisation from the Financial Conduct Authority to set up its own insurer, Post can reveal.

CFC reportedly considering stock market listing

Specialist insurance provider CFC is exploring options including a London Stock Exchange listing, according to a report by the Financial Times.

John Neal to lead AIG’s global GI business

Former Lloyd’s CEO John Neal will join AIG as president in December, reversing course on a previous decision to join Aon.

UK captives plans secure big broker backing

Aon and Marsh have backed plans to institute a UK captives regime, with the former saying it will launch a UK-domiciled captive management company in preparation for the new regulations.

Regulators and Treasury move to scale back SM&CR

Regulators and the Treasury have proposed streamlining the Senior Managers and Certification Regime to drive growth in the financial services sector.

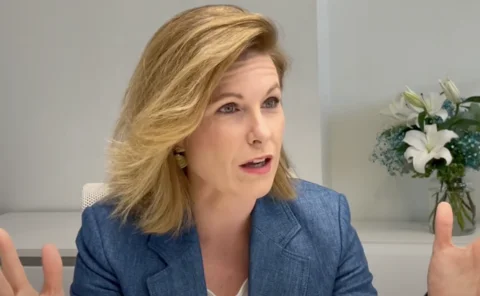

Big Interview: Blanca Berruguete, Descartes

Earlier this year Blanca Berruguete joined Descartes Underwriting as head of Europe, Middle East and Africa distribution and client management.

Resilience’s updated cyber proposition attracts large corporate interest

Cyber insurance provider Resilience has made inroads with 20 to 30 large corporate clients since lifting its appetite cap and launching new tools designed to make the risks facing complex conglomerates more visible.

ABI reveals £104m Covid fund’s impact

The ABI has announced a partnership with the National Emergencies Trust alongside the publication of a report outlining the impact of funds donated to a range of charities by the industry during the Covid-19 pandemic.

Insurers explore alternatives to blanket PFAS exclusions

Insurers are keen to take a “nuanced approach” to underwriting liabilities associated with so-called ‘forever chemicals’, according to Clyde & Co legal director Natasha Lioubimova.

SiriusPoint International on track to hit $750m GWP this year

SiriusPoint International is on track to write in the region of $750m of premium by the end of 2025, Post can reveal.

Hybrid fronts tipped to become ‘prevailing’ insurance model

Hybrid fronting is increasingly gaining market acceptance and has the potential to become the “prevailing” model of insurance, Bridgehaven chairman Erik Matson has said.

Q&A: Edward Ambrose, RSA

Edward Ambrose, UK head of professional indemnity at RSA, tells Post about the development of the insurer’s pioneering climate professionals PI product, which launched last year, and its reception in the market.

Supreme Court to decide if insurers can keep furlough ‘windfall’

The Supreme Court has granted policyholders permission to appeal the issue of furlough payments in relation to Covid-era business interruption claims.

Rise in investor lawsuits threatens to reshape UK D&O market

A rise in collective legal actions brought by shareholders against listed UK companies could reshape the market for directors’ and officers’ cover, chair of Clyde & Co’s global insurance practice group James Cooper has warned.

Big Interview: Dave Haynes, Arag

Arag UK CEO Dave Haynes sits down with Harry Curtis to discuss what the impact of the legal expenses insurer’s acquisition of Das and how Labour’s legislative make its products more relevant than ever.

Markel innovates to drive down London market costs

Markel has increasingly turned to automatic and fast follow models as it seeks to drive down the cost of doing business in the London market, managing director of distribution strategies and business development Dan Martin has told Post.

Probitas writes biggest ever risk following Aviva buildout

Aviva’s specialty product launches are resonating with customers, with its Lloyd’s syndicate writing its largest-ever single risk earlier this year, according to global corporate and specialty managing director Matt Washington.

Q&A: Stuart Heath, Tokio Marine HCC

Earlier this year, Tokio Marine HCC appointed Stuart Heath as international head of distribution in addition to his role as head of delegated property. He told Post about how the insurer is hoping to ride out the soft market and its biggest growth…

Ferma elects Philippe Cotelle as president

The Federation of European Risk Management Associations has elected Airbus Defence and Space’s Philippe Cotelle as its next president.

M&S and Co-op cyber attacks could cost up to £440m

The Cyber Monitoring Centre has categorised the recent cyber attacks on M&S and Co-op as a category two incident, estimating the combined financial impact of the attacks at £270m to £440m.

Retail attacks lay bare everyday cyber security challenges

While headlines about recent cyber attacks suffered by UK retailers, such as M&S, may renew interest in cyber insurance, the attacks are not a departure from the threat landscape companies already faced, market experts have told Post.

London shouldn’t be allowed to dominate UK captives sector

Industry leaders have warned that efforts to launch a UK captives sector would need to be a nationwide initiative, and not just focus on London in order to fully realise the opportunity at hand.

Aon using AI to identify insurer breaking points

Aon UK CEO Jane Kielty has revealed the broker is using artificial intelligence to identify points in the negotiation process where it may be able to extract more favourable terms from insurers.