Articles by Emma Ann Hughes

Classic car insurance keeps vintage motors running

How the classic car insurance market has geared up for changing vehicle values, supply chain challenges, shifting owner expectations, plus environmental pressures is examined by Emma Ann Hughes.

Reinventing motor insurance for the app generation

A special episode of the Insurance Post Podcast for Motor Week examines how subscription services, car-sharing platforms, and mobility apps are reshaping motor insurance.

Lloyd’s leads City breast and chest cancer checks campaign

Lloyd’s will host what organisers claim is the largest ever City-wide workplace health and wellbeing campaign this month.

Regulators to tackle motor claims management practices

The Financial Conduct Authority, Solicitors Regulation Authority, Information Commissioner’s Office and the Advertising Standards Authority plan to tackle misleading advertising and information about motor finance claims.

Fairer Finance demands FCA probe into pet cover limits

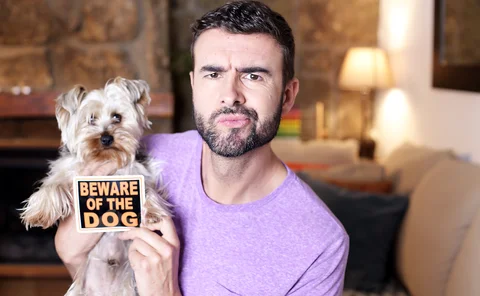

Fairer Finance has accused pet insurers of adding “deceptive” inner limits to policies marketed as comprehensive, which could leave owners facing thousands of pounds in unexpected vet bills.

FCA fines set to hit record low

2025 could see the lowest total value of fines issued by the Financial Conduct Authority in the regulator’s history, according to analysis by compliance and regtech platform Hackford.

RSA ends and Intact era begins with specialty lines plan

RSA will today (6 October) become Intact Insurance, with the insurer giving a taste of how it plans to double its UK and Ireland business to £5bn by 2030.

Jaguar Land Rover cyber-attack shows need for state action

Editor’s View: Jaguar Land Rover’s £50m-a-week cyber losses show why Labour must work with insurers now to build national resilience, according to Emma Ann Hughes.

AI forces brokers to rethink recruitment and client care

Phil Williams, group chief commercial officer and managing director of retail at Clear Group, has warned brokers that artificial intelligence means they need to rethink how they recruit talent.

Zurich reveals ‘puzzle pieces’ approach to AI is paying off

Zurich Insurance is reaping the rewards of a modular “puzzle pieces” approach to artificial intelligence, according to Penny Jones, responsible AI lead at the insurer.

CII to adapt for AI-dominated insurance sector

The Chartered Insurance Institute’s CEO Matthew Hill has urged the sector to embrace artificial intelligence “not as a threat, but as a tool”. But warned professionalism, ethics and human judgment must remain central as the technology reshapes the…

Insurance Post’s Top 80 MGAs of 2025 revealed

Policy Expert is the UK’s biggest MGA thanks to an 8% swell in its customer base, reaching 1.6m policies for the first time this year.

Are we ready for cyber catastrophes?

The latest episode of the Insurance Post Podcast explores whether the insurance market, businesses and governments are truly prepared for cyber catastrophes.

Pen Underwriting’s plan to becoming biggest MGA

After Pen Underwriting hit a five-year goal of managing around £1bn of gross written premium a year ahead of schedule, Nick Wright, chief development officer, has revealed how the MGA will achieve £1.75bn by the end of this decade.

CII conference to examine how AI is reshaping insurance

“Artificial intelligence won’t replace your job, but someone who uses AI better than you will,” warns Artur Niemczewski, AI champion and former non-executive director of the Chartered Insurance Institute.

Q&A: Brett Sainty, BLW Insurance Brokers

Brett Sainty, CEO of BLW Insurance Brokers, shares how he intends to double the business in the next five years plus what differentiates it from the consolidators.

Defaqto CEO questions forecasts of AI-led insurance decisions

Defaqto CEO John Milliken has raised doubts over predictions that generative and agentic artificial intelligence will soon dominate how consumers choose general insurance products.

Sparking debate: Lithium-ion risks

The latest episode of the Insurance Post Podcast tackles the growing risks and insurance challenges posed by lithium-ion batteries.

Big Interview: Andy Rice, Charles Taylor Adjusting

From a guitar-playing teenager to CEO of Charles Taylor Adjusting International, Andy Rice shares how his loss adjusting journey started in 1985 and outlines how he is orchestrating to growing the business globally in 2025.

Which? makes super-complaint against FCA over insurance failings

Which? has issued a super-complaint to the Financial Conduct Authority, accusing the regulator of failing to tackle persistent problems in the home and travel insurance markets.

Allianz UK uncovers £93m in insurance fraud

Allianz UK identified more than 15,800 fraudulent cases across personal, commercial and specialty lines, worth a total of £92.6m in the first half of 2025.

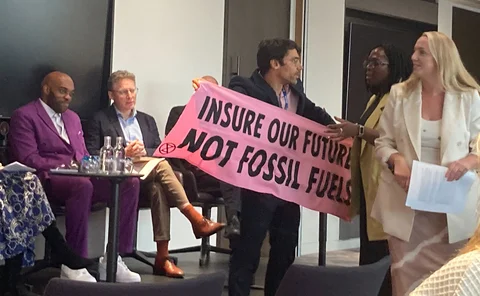

Protesters interrupt closing events of Dive In Festival

The plug was pulled on one of the final sessions of this year’s Dive In Festival on Thursday afternoon (18 September) after a climate change activist stepped onto the stage.

Dive In proves insurance superheroes no longer need masks

Editor’s View: Insurance once rewarded only Superman-style displays of strength, but as Emma Ann Hughes observes, this year’s Dive In shows the sector now thrives when Clark Kent qualities are embraced.

Actress warns domestic abuse hits insurers’ profits

Actress Samantha Beckinsale has warned insurers that domestic abuse is directly impacting the industry by stripping victims of their financial independence and ability to maintain cover.

.jpg7690.webp)